Municipality Examination

Grade XI

2079 (2022)

Accounting

Regular Students

Time - 3 hrs

Full Marks - 75

Pass Marks - 27

Candidates are required to give their answers in their own words as far as practicable. The figures in the margin indicate full marks.

Also Check:-

Note: Don't use Dark mode

Group 'A'

Very short answer questions.

Attempt all questions. (11x1==11)

1. What is bookkeeping?

2. What is meant by the "business entity concept"?

3. State the scope of accounting.

4. Explain in short any two features of the double-entry system.

5. What is trail balance?

6. Write any two differences between capital and revenue expenditure.

7. What is provision? Why it is created?

8. What is depreciation? Explain any two causes.

9. Write any two features of the government accounting system.

10. Write any two differences between government and commercial accounting.

11. What is a petty cash book? Why it is prepared?

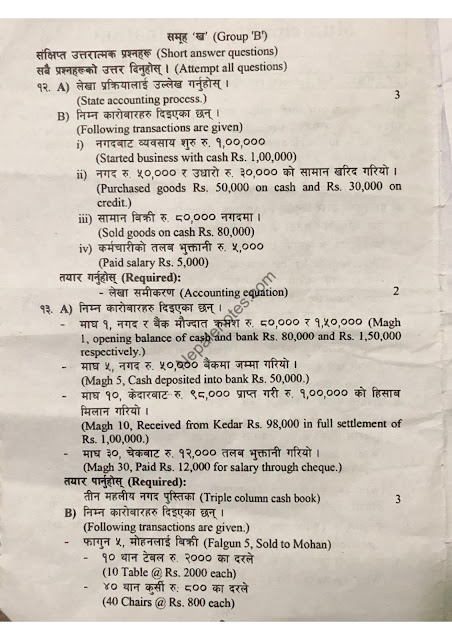

Group 'B'

Short answer questions.

Attempt all questions

12.

A) State accounting process. (3)

B) Following transactions are given

i) Started business with cash Rs. 1,00,000

ii) Purchased goods Rs. 50,000 on cash and Rs. 30,000 on credit.

iii) Sold goods on cash Rs. 80,000

iv) Paid salary Rs. 5,000

Required:

Accounting equation (2)

13.

A) Following transactions are given.

- Magh 1, opening balance of cash and bank Rs. 80,000 and Rs. 1,50,000 respectively.

- Magh 5, Cash deposited into bank Rs. 50,000.

- Magh 10, Received from Kedar Rs. 98,000 in full settlement of Rs. 1,00,000.

- Magh 30, Paid Rs. 12,000 for salary through cheque.

Required:

Triple column cash book (3)

B) Following transactions are given.

- Falgun 5, Sold to Mohan

-10 Table @Rs. 2000 each

-40 Chairs @Rs.800 each

- Falgun 10, Sold to Ratna Store

-20 Bed @Rs .4000 each

-5 Table @Rs. 2000 each

-10% trade discount

Required:

Sales Book (2)

14. Following information is given

i) On falgun 30, the balance of the bank passbook was Rs. 80,000. On reconciliation with the cash book, the following differences are located.

ii) Cheque issued but not presented for payment Rs. 5,000.

iii) Cheque sent for collection Rs. 10,000 not deposited by the bank.

iv) Insurance Rs. 4,000 directly paid by the bank.

v) Rs. 3,000 directly by the customer in a bank account but not required in the cash book.

Required:

Bank Reconciliation statement. (5)

15.

A) Following errors were located before the preparation of the trial balance.

i) Salary paid to Ram Rs.5,000 was debited to Ram's account.

ii) Goods purchased from Jaya for Rs. 20,000 was recorded in the sales account.

iii) Purchased book is overcast Rs. 2,000

Required:

Entries for rectification (3)

B) The following information is extracted from the trial balance

| Particulars | Debit Rs. | Credit Rs. |

|---|---|---|

| Provision for bad debt | 52,000 | |

| Sunday debtors | 7,000 | |

| Bad debt | 1,000 |

Additional Information

a) Bad Debt Rs. 2,000

b) Provision for bad debt 5%

Required:

Provision for bad debt account (2)

OR

An unadjusted trial balance of 'A' trading concern is given below.

| Particulars | Debt Rs. | Credit Rs. |

|---|---|---|

| Bank | 20,000 | |

| Purchase | 46,000 | |

| Debtors | 22,000 | |

| Furniture | 50,0000 | |

| Salary | 40,000 | |

| Prepaid Rent | 12,000 | |

| Sales | 90,000 | |

| Capital | 60,000 | |

| Creditors | 40,000 | |

| Total | 1,90,000 | 1,90,000 |

Additional Information

i) Salary due Rs. 3,000

ii) Depreciation on furniture @10%

iii) Prepaid rent expired Rs. 2,000

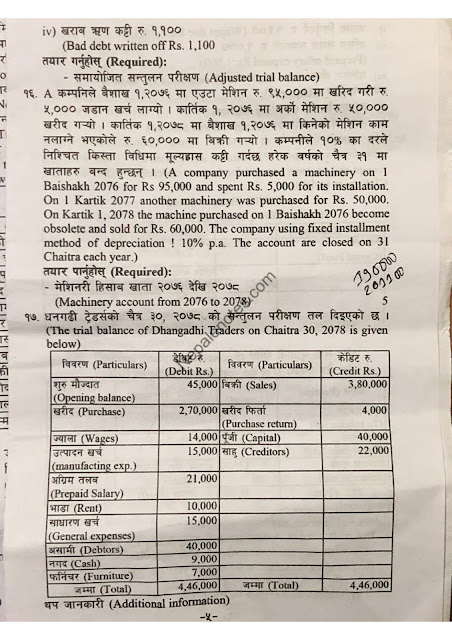

iv) Bad debt is written off Rs. 1,100

Required:

- Adjusted trial balance

16. A company purchased machinery on 1 Baishakh 2076 for Rs. 95,000 and spent Rs. 5,000 for its installation. On 1 Kartik 2077, another machinery was purchased for Rs. 50,000 for its installation. On Kartik 1, 2078 the machine purchased on 1 Baishakh 2076 become obsolete and sold for Rs. 60,000. The company uses a fixed installment method of depreciation! 10% p.a. The account is closed on 31 Chaitra each year.

Required:

- Machinery account from 2076 to 2078

17. The trial balance of Dhangadhi Traders on Chaitra 30, 2078 is given below.

| Particulars | Debt Rs. | Particulars | Credit Rs. |

|---|---|---|---|

| Opening balance | 45,000 | Sales | 3,80,000 |

| Purchase | 2,70,000 | Purchase return | 4,000 |

| Wages | 14,000 | Capital | 40,000 |

| Manufacturing Exp. | 15,000 | Creditors | 22,000 |

| Prepaid Salary | 21,000 | ||

| Rent | 10,000 | ||

| General Expenses | 15,000 | ||

| Debtors | 40,000 | ||

| Cash | 9,000 | ||

| Furniture | 7,000 | ||

| Total | 4,46,000 | Total | 4,46,000 |

Additional Information

i) Wages due Rs.1,500

ii) Prepaid salary expired Rs. 1,000

iii) Closing stock Rs. 49,000

Required:

a) Trading account

b) Profit and loss account (2+3=5)

18. The balance sheet as of 2077 Chaitra 30, and receipt and payment account for the year ended 2078 Chaitra 30 of a Club are as under.

Balance Sheet

As of 30th Chaitra 2077

| Liabilities | Rs. | Assets | Rs. |

|---|---|---|---|

| Capital Fund | 25,000 | Furniture | 10,000 |

| Subscription due | 2,000 | ||

| Cash Balance | 13,000 | ||

| Total | 25,000 | Total | 25,000 |

Receipt and payment account

For the year ended 30 Chaitra 2078

| Receipt | Amount | Payment | Amount |

|---|---|---|---|

| To balance b/d | 13,000 | By salary | 10,000 |

| To entrance fees | 5,000 | By Rent | 5,000 |

| Subscriptions | 17,000 | By balance c/d | 20,000 |

| Total | 35,000 | Total | 35,000 |

Additional Information

i) Outstanding Salary Rs. 1,000

ii) Outstanding subscription for the current year Rs.500

iii) Depreciation on furniture by Rs. 1,000

Required:

a) Income and expenditure account

b) Balance sheet as of 30 Chaitra 2078

19.

A) A trader started a business with Rs. 2,00,000 at the end of the year his position was as under.

Furniture- Rs. 1,00,000

Cash- Rs. 50,000

Creditors- Rs. 20,000

Debtors- Rs. 1,00,000

Stock- Rs. 30,000

Additional Information

i) Drawing for his personal use Rs. 15,000

ii) Depreciate furniture 10%

Required:

i) Closing statement of affairs

ii) Statement of profit and loss (2)

B) Following transactions of a Government office are given.

- Magh 6, an Issued cheque of Rs. 25,000 to purchase a computer.

- Magh 10, Ram's furniture advance has been cleared against the bill of Rs. 84,000 and bank voucher Rs. 16,000 were submitted by him.

- Magh 30, Total employee remuneration of Magh Rs. 33,000 was distributed after deducting provident fund Rs. 6,000, Social security tax Rs. 300, and income tax Rs. 1500.

Required:

Journal Voucher (5)

OR

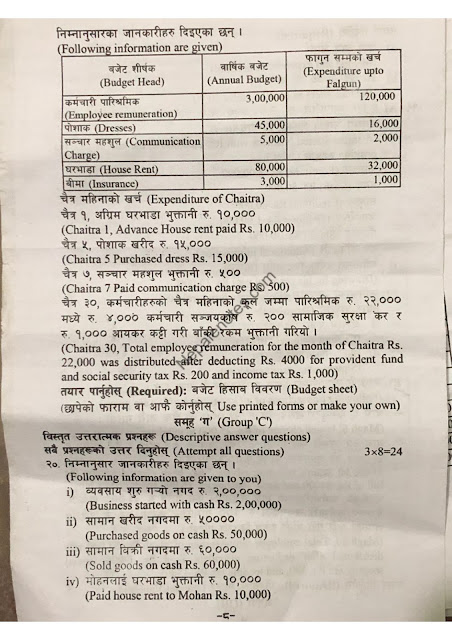

The following information is given

| Budget Head | Annual Budget | Expenditure upto Falgun |

|---|---|---|

| Employee remuneration | 3,00,000 | 1,20,000 |

| Dresses | 45,000 | 16,00 |

| Communication Charge | 5,000 | 2,000 |

| House Rent | 80,000 | 32,000 |

| Insurance | 3,000 | 1,000 |

Expenditure of Chaitra

- Chaitra 1, Advance House rent paid Rs. 10,000

- Chaitra 5, Purchased dress Rs. 15,000

- Chaitra 7, Paid communication charge Rs. 500

- Chaitra 30, Total employee remuneration for the month of Chaitra Rs. 22,000 was distributed after deducting Rs..4,000 for provident fund and social security tac Rs. 200 and income tax Rs. 1,000

Required:

Budget Sheet

Use printed forms or make your own

Group 'C'

Descriptive answer questions

Attempt all questions

20. Following information is given to you

i) Business started with cash Rs. 2,00,000

ii) Purchased goods in cash Rs. 50,000

iii) Sold goods in cash Rs. 60,000

iii) Sold goods in cash Rs. 60,000

iv) Paid house rent to Mohan Rs. 10,000

v) Commission received Rs. 5,000

Required:

a) Journal entries

b) Necessary ledger

c) Trail balance

21. The trial balance of Pokhara Traders as of 31 Dec 2021 is given below.

| Particulars | Debit Rs. | Credit Rs. |

|---|---|---|

| Capital | 4,00,000 | |

| Sales revenue | 8,75,000 | |

| Bank Loan | 3,50,000 | |

| Account payable | 3,50,000 | |

| Cash | 1,90,000 | |

| Debtors | 1,10,000 | |

| Fixed Assets | 5,00,000 | |

| Administrative expenses | 1,50,000 | |

| Salary | 1,00,000 | |

| Selling expenses | 50,000 | |

| Purchase | 5,25,000 | |

| Wages | 50,000 | |

| Total | 16,75,000 | 16,75,000 |

Additional information

i) Depreciation on fixed assets @10%

ii) Salary payable Rs. 10,000

iii) Closing stock Rs. 1,25,000

Required:

a) Multi-step income statement

b) Classified Balance sheet (4+4=8)

OR

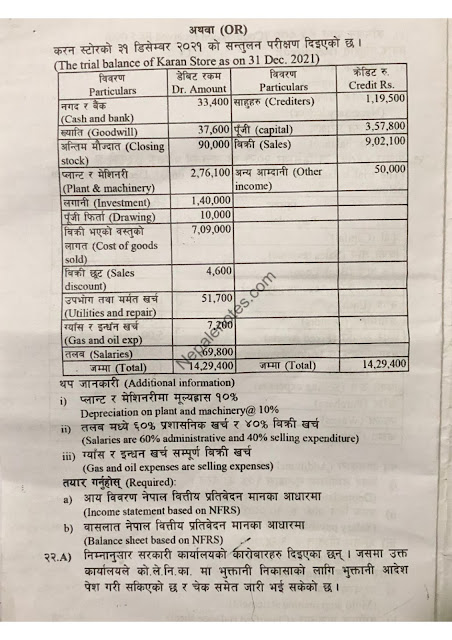

The trial balance of Karan Store as of 31 Dec. 2021

| Particulars | Dr. Amount | Particulars | Credit Rs. |

|---|---|---|---|

| Cash and bank | 33,400 | Credits | 1,19,500 |

| Goodwill | 37,600 | Capital | 3,57,800 |

| Closing stock | 90,000 | Sales | 9,02,100 |

| Plant % machinery | 2,76,100 | Other income | 50,000 |

| Investment | 1,40,000 | ||

| Drawings | 10,000 | ||

| Cost of goods | 7,09,000 | ||

| Sales discount | 4,600 | ||

| Utilities and repair | 51,700 | ||

| Gas and oil expense | 7,200 | ||

| Salaries | 69,800 | ||

| Total | 14,29,400 | Total | 14,29,400 |

Additional information

i) Depreciation on plant and machinery @10%

ii) Salaries are 60% administrative and 40% selling expenditure

iii) Gas and oil expenses are selling expenses

Required:

a) Income statement based on NFRS

b) Balance sheet based on NFRS

22.

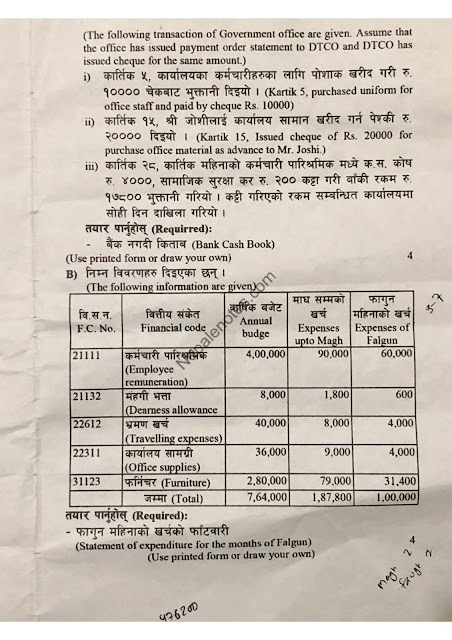

A) The following transaction of the Government officials are given. Assume that the office has issued a payment order statement to DTCO and DTCO has issued a cheque for the same amount.

i) Kartik 5, purchased uniform for office staff and paid by cheque Rs.10,000

ii) Kartik 15, Issued cheque of Rs. 20,000 for the purchase of office material as an advance to Mr. Joshi.

Required:

-Bank Cash Book (Use the printed form or draw your own)

B) The following information is given

| F.C. No. | Financial Code | Annual Budget | Expenses upto Magh | Expenses of Falgun |

|---|---|---|---|---|

| 21111 | Employee remuneration | 4,00,000 | 90,000 | 60,000 |

| 21132 | Dearness allowance | 8,000 | 1,800 | 600 |

| 22612 | Traveling expenses | 40,000 | 8,000 | 4,000 |

| 22311 | Office supplies | 36,000 | 9,000 | 4,000 |

| 31123 | Furniture | 2,80,000 | 79,000 | 31,400 |

| Total | 7,64,000 | 1,87,800 | 1,00,000 |

Required:

-Statement of expenditure for the months of Falgun (Use the printed form or draw your own)