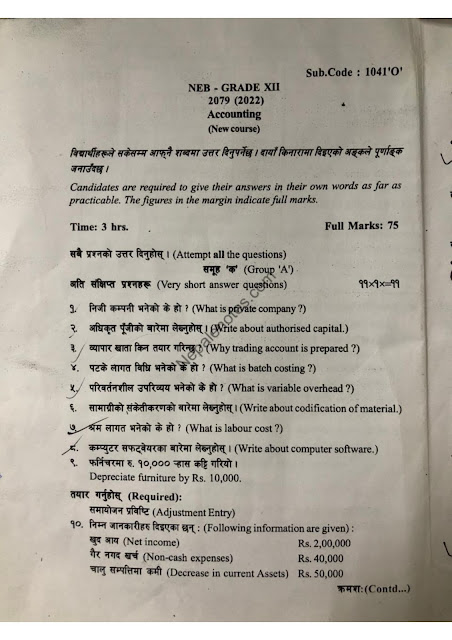

NATIONAL EXAMINATIONS BOARD [NEB]

NEB - Grade XII

2079 (2022)

Accounting

Regular Students | Subject Code: 1041 'O'

Time - 3 hrs

Full Marks - 75

Pass Marks - 27

Candidates are required to give their answers in their own words as far as practicable. The figures in the margin indicate full marks.

Also Check:-

Note: Don't use Dark mode

Attempt all the questions.

Group A

Very short answer questions. 11x1=11

1. What is a private company?

2. Write about authorized capital.

3. Why trading account is prepared?

4. What is batch costing?

5. What is variable overhead?

6. Write about the codification of material.

7. What does labor cost?

8. Write about computer software.

9. Depreciate furniture by Rs. 10,000.

Required:

Adjustment Entry

10. Following information is given below:

Net income Rs. 2,00,000

Non-cash expenses Rs. 40,000

Decrease in current Assets Rs. 50,000

Required:

Cash flow from operating activities using the direct method.

11. Following information is given below:

Annual material requirement 50,000 kg

Economics order quantity 2,000 kg

Required:

No. of orders

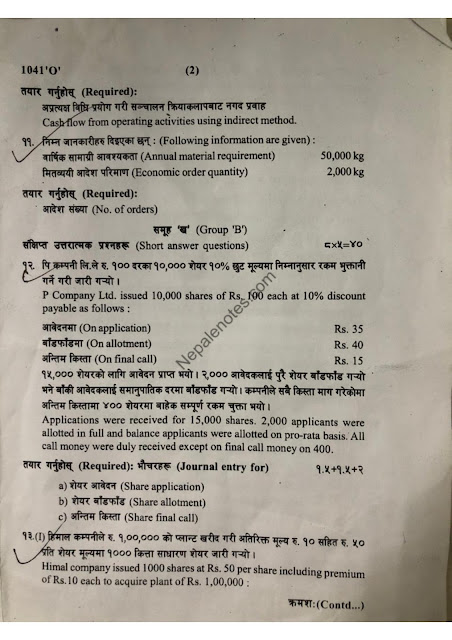

Group B

Short answer questions. 8x5=40

12. P Company Ltd. issued 10,000 shares of Rs. 100 each at a 10% discount payable as follows:

On application Rs. 35

On allotment Rs. 40

On the final call Rs. 15

Applications were received for 15,000 shares. 2,000 applicants were allotted in full and balance applicants were allotted on a pro-rata basis. All call money was duly received except for final call money on 400.

Required: Journal entry for 1.5+1.5+2

a) Share application

b) Share allotment

c) Share the final call

13. (I) Himal company issued 1000 shares at Rs. 50 per share including a premium of Rs. 10 each to acquire a plant of Rs. 1,00,000 :

Required: 1+1

Entry for purchase of the plant by issuing share

(II) A company issued 5,000, 8% debentures of Rs. 1000 each at 10% premium and redeemable after 5 years at par.

Required: 2+1

Journal Entries for issue and redemption of debenture

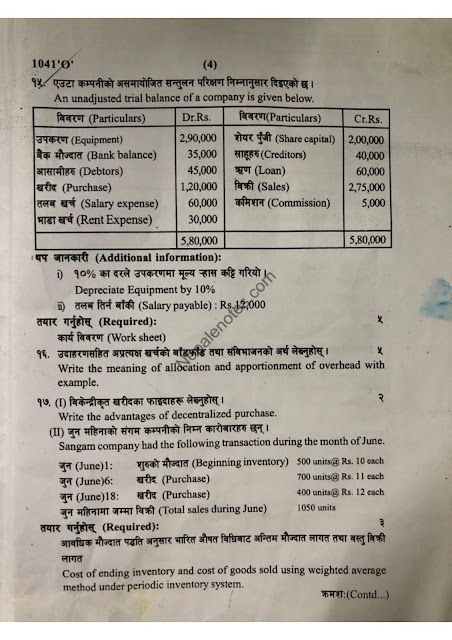

14. A trial balance of a company as of 31st December is as under.

| Particulars | Dr. Rs. | Particulars | Cr. RS. |

|---|---|---|---|

| Plant & Machinery Building Bank balance Debtors Prepaid insurance Closing stock | 4,60,000 6,00,000 80,000 60,000 12,000 50,000 | Share capital General Reserve Creditors Net Profit Opening Retained earning Long term loan | 8,00,000 1,20,000 25,000 80,000 37,000 2,00,000 |

| 12,62,000 | 12,62,000 |

Additional information:

a) Proposed dividend. Rs. 80,000

b) Transfer to general reserve. Rs. 20,000

Required: 2+3

a) Profit & loss appropriation account

b) Balance sheet

15. An unadjusted trial balance of a company is given below:

| Particulars | Dr. Rs. | Particulars | Cr. RS. |

|---|---|---|---|

| Equipment Bank balance Debtors Purchase Salary expense Rent expense | 2,90,000 35,000 45,000 1,20,000 60,000 30,000 | Share capital Creditors Loan Sales Commission | 2,00,000 40,000 60,000 2,75,000 5,000 |

| 5,80,000 | 5,80,000 |

Additional information:

a) Depreciate Equipment by 10%

b) Salary payable: Rs. 12,000

Required: 5

Worksheet

16. Write the meaning of allocation and apportionment of overhead with example. 5

17. (I) Write the advantage of the decentralized purchase. 2

(II) Sangam company had the following transaction during the month of June.

Required: 3

Cost of ending inventory and cost of goods sold using weighted average method under periodic inventory system.

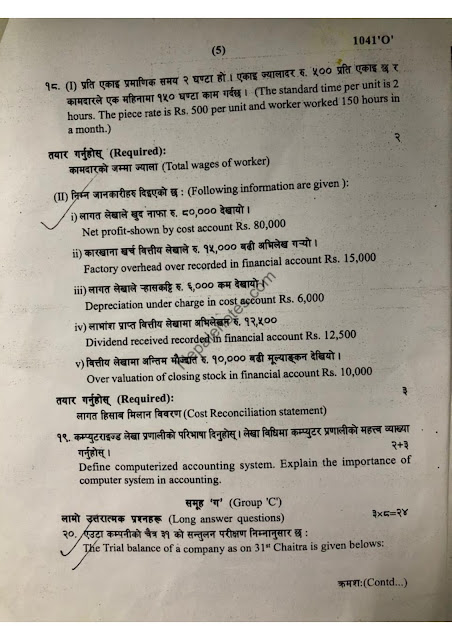

18. (I) The standard time per unit is 2 hours. The piece rate is Rs. 500 per unit and workers 150 hours in a month.

Required: 2

Total wages of a worker

(II) Following information is given:

i) Net profit-shown by cost account Rs. 80,000

ii) Factory overhead over recorded in financial account Rs. 15,000

iii) Depreciation under charge in cost account Rs. 6,000

iv) Divided received recorded in financial account Rs. 10,000

Required: 3

Cost Reconciliation statement

19. Define a computerized accounting system. Explain the importance of computer systems in accounting. 2+3

| June 1: June 6: June 8: | Beginning inventory Purchase Purchase Total sales during June | 500 units@ Rs. 10 each 700 units@ Rs. 11 each 400 units@ Rs. 12 each 1050 units |

Group C

Long answer questions. 3x8=24

20. The trial balance of a company as of 31st Chaitra is given below:

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

|---|---|---|---|

| Opening stock | 40,000 | Sales | 6,50,000 |

| Purchase | 4,00,000 | Share capital | 4,00,000 |

| Wages | 66,000 | 12% debentures | 2,00,000 |

| Carriage | 7,000 | Purchase return | 40,000 |

| Salary | 60,000 | Provision for bad debt | 3,000 |

| Debtors | 1,00,000 | Provision for tax | 10,000 |

| Machinery | 6,00,000 | Profit & loss account | 2,80,000 |

| Cash | 80,000 | ||

| Selling expense | 20,000 | ||

| Rent | 60,000 | ||

| Interest on debenture | 16,000 | ||

| Bad debt | 14,000 | ||

| Investment | 1,20,000 | ||

| 15,83,000 | 15,83,000 |

Additional information:

i) Closing stock: Rs. 3,00,000

ii) Depreciate machinery by 10%

iii) Profit transferred to general reserve Rs. 30,000

iv) Proposed dividend of 10% on share capital

Required

a) Profit or loss statement based on NFRS

b) Statement of final position based on NFRS

OR

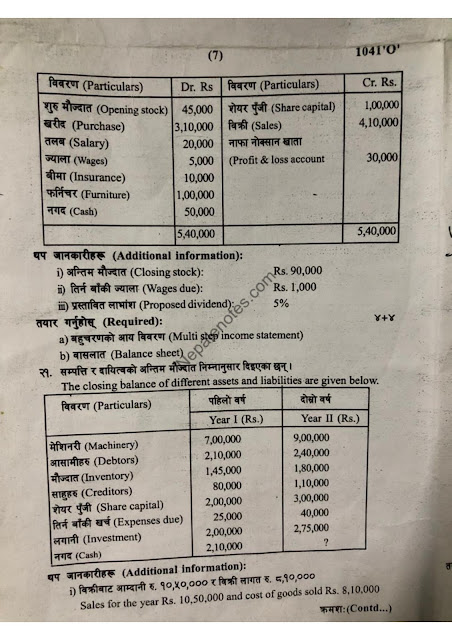

Trial Balance of a limited company as of 31 Chaitra is given below:

| Particulars | Dr. Rs. | Particulars | Cr. Rs. |

|---|---|---|---|

| Opening stock | 45,000 | Share capital | 1,00,000 |

| Purchase | 3,10,000 | Sales | 4,10,000 |

| Salary | 20,000 | Profit & loss account | 30,000 |

| Wages | 5,000 | ||

| Insurance | 10,000 | ||

| Furniture | 1,00,000 | ||

| Cash | 50,000 | ||

| 5,40,000 | 5,40,000 |

Additional information:

i) Closing stock: Rs. 3,00,000

ii) Wages due: Rs. 1,000

iii) Proposed dividend: 5%

Required

a) Multi-step income statement

b) Balance sheet

21. The closing balance of different assets and liabilities are given below:

| Particulars | Year I (Rs.) | Year II (Rs.) |

|---|---|---|

| Machinery Debtors Inventory Creditors Share capital Expenses due Investment Cash | 7,00,000 2,10,000 1,45,000 80,000 2,00,000 25,000 2,00,000 2,10,000 | 9,00,000 2,40,000 1,80,000 1,10,000 3,00,000 40,000 2,75,000 ? |

Additional information:

i) Sales for the year Rs. 10,50,000 and cost of goods sold Rs. 8,10,000

ii) Operating expenses Rs. 2,05,000, including depreciation Rs. 65,000

iii) Machinery sold for Rs. 1,25,000 and purchased for Rs. 3,80,000

iv) Dividend paid for the year Rs. 20,000

Required

a) Cash flow statement

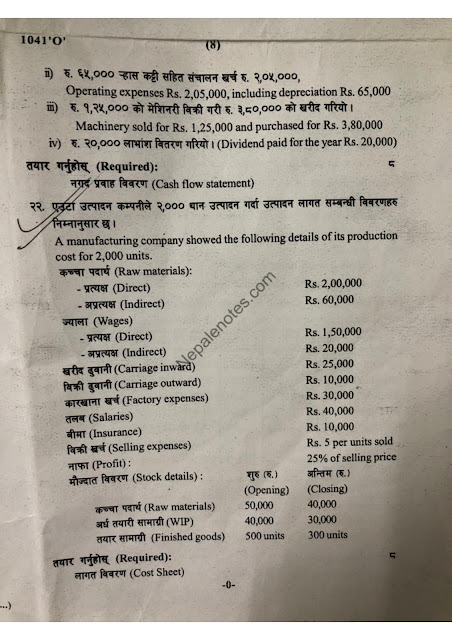

22. A manufacturing company showed the following details of its production cost for 2,000 units.

Raw materials:

-- Direct Rs. 2,00,000

-- Indirect Rs. 60,000

Wages:

-- Direct Rs. 1,50,000

-- Indirect Rs. 20,000

Carriage inward Rs. 25,000

Carriage outward Rs. 10,000

Factory expenses Rs. 30,000

Salaries Rs. 40,000

Insurance RS. 10,000

Selling expenses Rs. 5 per unit sold

Proft: 25% of the selling price

Stock details: Opening Closing

Raw materials. 50,000 40,000

WIP. 40,000 30,000

Finished goods. 500 units 300 units

Required

a) Cost Sheet

Photos:-

Is it real?

ReplyDelete